What can you do with higher interest rates? – Reevaluate any bond investments you have

As I have written in my last two blogs, interest rates have been historically low since the Great Recession of 2007-2008. And although they have moved within a range during that time, the range has been low and it has been a long time since bond coupon rates have been attractive. But as the Federal Reserve Board continues to raise rates to fight inflation, we may be getting to a level where investing in longer term bonds makes sense.

There are two things that lead my thinking on this topic. First, if I can a get coupon rates in the 6-7% range for quality corporate bonds, that is appealing. Particularly when stock investments are volatile, if I can have a portion of my portfolio bringing in 6-7% interest that would be helpful to create growth. We aren’t quite to that point yet, but we may be after a few more rate hikes, so keep this on your radar screen.

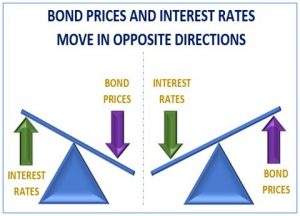

The second part of this idea that is interesting is what happens to rates in late 2023 and beyond. I believe that the Fed will have to raise rates above what is typical to stop inflation and then the next move will be to reduce them. If that is the case and you own bonds while interest rates are declining, the value of those bonds usually goes up. And the longer the duration of your bonds, the more they move in response to interest rates.

One strategy is once you think we have hit the peak of interest rates, consider buying bonds to lock in those nice coupon rates, this will give you income to support your stock positions. You may want to consider investing in longer term bonds if you are guessing the next move for rates will be down to try and capture some price appreciation in your bonds. And finally, if you have been low in your allocation to bonds, this might be a good time to adjust that and consider adding more bonds to the mix.

As always, I recommend you work on this project of reevaluating your bonds with a financial advisor who understands these markets and has some solid experience trading bonds. If you would like to talk to someone on our team please feel free to hit the “schedule an appointment” button and find a time that works.

No strategy assures success or protects against loss. Asset allocation does not ensure a profit or protect against loss. Bonds are subject to credit, market, and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.